|

|

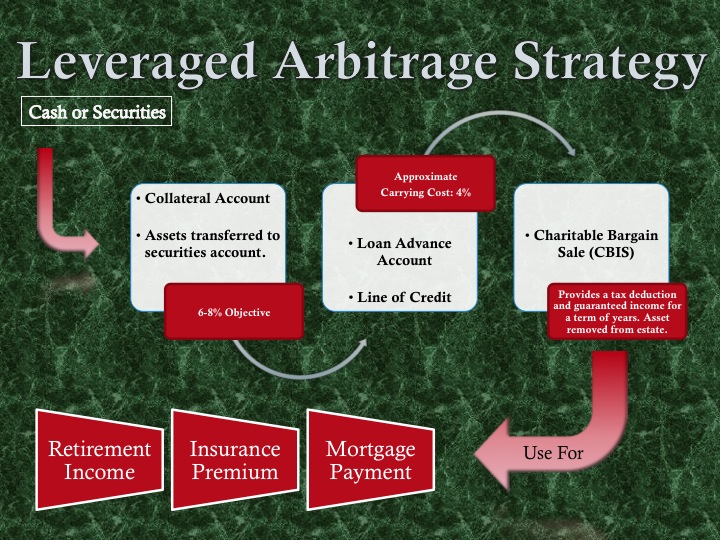

Leveraged Arbitrage Strategy Are you faced with the proposition of depleting current assets to pay off a mortgage, loan, funding long-term care or purchasing a long-term care policy, purchasing a life insurance policy or simply providing lifetime retirement income. You may want to consider a strategy we call leveraged arbitrage.

Imagine the benefit of achieving your goals by purchasing products and services without having to liquidate an equal amount of assets. For example, if you need to pay off a mortgage or other loan (or even buy a house), purchase an insurance policy, or simply provide retirement income that you cannot outlive, a leveraged arbitrage strategy can help you achieve this without spending down your own assets.

The strategy consists of a number of processes you can set-up individually; then we string them together in a cohesive manner to provide you with a plan that is unique to your goals and objectives and that will multiply the purchasing power of your assets.

Benefits You will receive as part of your leveraged arbitrage strategy:

|

||||||||||||